February 6, 2007

GMO Internet Group Establishes

Joint Venture with Lehman Brothers Japan

- GMO Internet, Inc.

Tokyo – February 6, 2007 -- A new money lending and loan asset acquisition company to be jointly operated by GMO Internet Inc. and Lehman Brothers Japan Inc. has been established.

Background to the Establishment of the New Company

The industry is facing a turning point as factors in the consumer loan industry environment including a reduction in the maximum allowable interest rate under the Investment Deposit and Interest Rate Law and reforms to money lending laws aimed at tightening regulation of companies in the industry cause companies to withdraw from the industry or close down.

GMO NetCard Inc. is the loans and credit business strategic subsidiary of the GMO Internet Group. GMO NetCard has enhanced cost competitiveness through such measures as diversification of fund procurement methods through securitization and branch reorganization into a non-store operation. At the same time, in order to handle customer enquiries efficiently and effectively it has integrated telephone and other analog information with digital information and converted to a call center business that allows for the provision of detailed attention to customers. It has also strengthened its basis for growth through the purchase of consumer loan assets from other companies. In September 2005 it became a member of the GMO Internet Group using the Internet to create an even more competitive cost structure and strengthen the foundation of the business.

GMO Internet had sought a strategic partner that had the financial knowledge necessary for the purchase of assets, the ability to procure funds and an advantageous competitive strength. The company welcomed the opportunity to enter a joint venture with Lehman Brothers Japan, an innovative investment bank that provides a vast range of financial services on a global scale.

The Agreement Concerning the Establishment of the New Company

Lehman Brothers Japan of the Lehman Brothers Group, GMO Internet and GMO NetCard have agreed as laid out below, to establish and jointly operate a new company with added business value by taking advantage of the GMO NetCard knowledge of creating cash flow through the efficient utilization of purchased assets and the Lehman Brothers Japan financial technology and ability to procure funds.

Reasons for the Establishment of the New Company

Reforms to money lending control laws that restrict the total amount a customer can borrow are likely force small and medium companies in the industry to tighten credit and be forced to suddenly adopt a collection policy at odds with customer demand for credit. This is likely to inconvenience certain customers. We expect an increase in the number of consumer loan companies that are forced to withdraw from the industry due to deteriorating business foundations impacting on the consumer loan industry. The company established under this agreement will perform the function of taking over the consumer loan assets of small and medium consumer finance companies that are unable to continue business. Taking over the loan assets of these companies allows us to create a safety net against the sudden shrinking of the consumer finance industry.

Outline of the New Company

|

(1)

|

Company Name

|

United Capital, Inc.

|

|

(2)

|

CEO

|

To Be Announced (now under consideration)

|

|

(3)

|

Address

|

To Be Announced (now under consideration)

|

|

(4)

|

Description of Main Business

|

Money lending business, acquisition of loan assets etc.

|

|

(5)

|

Capital

|

¥1,000,000,000(initial investment)

|

|

(6)

|

Total No. of Shares to be Issued

|

20,000(initial issue)

|

|

(7)

|

Shareholder Composition

|

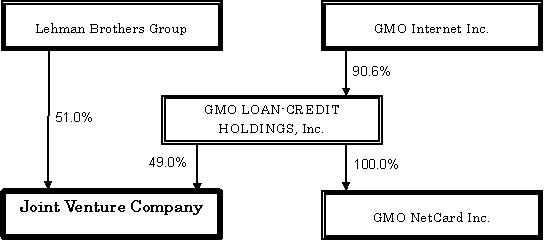

Lehman Brothers Group (51.0%)

GMO LOAN-CREDIT HOLDINGS, Inc.(49.0%)

|

Schedule

Capital increase scheduled to be completed in April 2007.

Outline of the GMO Internet Investment

The investment in the new company will come from a GMO Internet Group company. The investment is scheduled for mid-April. An outline of the scheduled investment is as follows:

Investment Amount: ¥490,000,000

Investment Amount: ¥490,000,000

Number of Shares to be Acquired: 9,800

Investment Ratio:49.0%

Diagram of the Planned Capital Relationship

Impact on GMO Internet Financial Results

The new company will become a GMO Internet equity method affiliate.

We expect this company to occupy a significant position in the GMO Internet Group Loans and Credit business however it is currently difficult to ascertain its influence. This information will be released as soon as it becomes available.

Media Enquiries

GMO Internet Inc. Group Public Relations Team: Aki Hosoda

Phone: +81-3-5456-2695 Fax: +81-3-3780-2611 E-mail: [email protected]

The GMO Internet Group

The GMO Internet Group is a leading force in the Internet industry offering one of the most comprehensive ranges of Internet services in Japan. We provide web hosting, e-commerce tools, domain registration, Internet advertising, online securities trading and a host of other services to over 22 million individual and 550 000 corporate customers. Striving to redefine the industry and foster a vibrant Internet culture, the GMO Internet Group is continuously working to inspire enthusiasm in our customers and put smiles on their faces.

Lehman Brothers Japan Inc.

|

Company Name

|

Lehman Brothers Japan Inc. http://www.lehman.com

|

|

Established

|

Business transferred from Lehman Brothers Tokyo Branch on December 16, 2006

|

|

Head Office Address

|

6-10-1 Roppongi, Minato-ku, Tokyo JAPAN

|

|

CEO

|

CEO Asia: Jasjit S. Bhattal

President: Akio Katsuragi

|

|

Business Description

|

Securities business

|

GMO Internet Inc

|

Company Name

|

GMO Internet Inc. http://www.gmo.jp/en

(Tokyo Stock Exchange, First Section: 9449)

|

|

Address

|

Cerulean Tower, 26-1 Sakuragaokacho, Shibuya-ku Tokyo, JAPAN

|

|

CEO

|

Masatoshi Kumagai

|

|

Business Description

|

■Internet Use Support (Infrastructure)Business

■Internet Advertising Support (Media) Business

■Internet Finance Business

|

|

Capital

|

¥7,148,290,000

|