October 5, 2016

A First for Japanese Banks: GMO-PG Jointly Develops Smartphone Payment Services Linked with Accounts at Bank of Yokohama

- Enable to make instant payments from their accounts on their smartphone apps -

- GMO Payment Gateway, Inc.

GMO-PG and the Bank of Yokohama, Ltd. will jointly develop a smartphone payment service (smartphone payment service “Hama Pay”) which the bank plans to start offering in March 2017. The smartphone payment service will be linked with accounts at the Bank of Yokohama and enable customers to make instant payments from their accounts on their smartphone apps. It will be the first time for a Japanese bank to offer such a service.

(Currently applying for patent jointly with the Bank of Yokohama; 2016-109869)

【Background and Overview】

Since 2014, GMO-PG has been offering smartphone payment services for credit card purchases at restaurants and physical vendors of clothes and other items. These payments do not require customers to carry around a wallet (*1), since they may be completed on a smartphone app. A high rate of compatibility now exists between finance and IT—dubbed financial technology, or “Fintech”, which exists in systems that link customers with stores through smartphone apps, GMO-PG has also been offering its services to financial institutions and various other entities.

In order to support new initiatives which are underway at the Bank of Yokohama, GMO-PG has decided to leverage the knowledge, expertise, and technical strengths that it has accumulated through its smartphone payment services. It will collaborate with the bank to jointly develop a smartphone payment service that will enable people to make payments, not by credit or debit card but instead, directly from their bank accounts.

(*1) Started from April, 2014. URL:https://www.gmo-pg.com/service/smart-check/

【About the Smartphone Payment Service Linked with Bank of Yokohama Accounts】

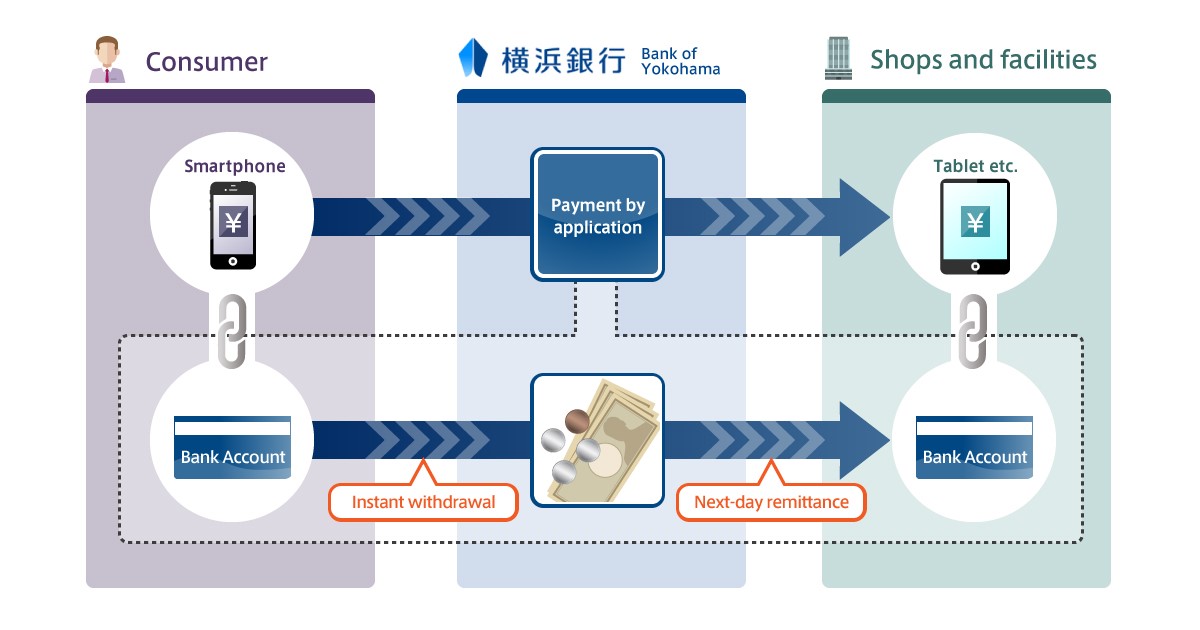

The Bank of Yokohama is planning to start offering smartphone payment service linked with accounts at its bank in March 2017. The service will enable people to make payments from their accounts instantly through a smartphone app. While services have previously existed where payments can be made from a smartphone if agreements for the transfer of funds are made in advance with each individual merchant, the new service will be the first to offer instantaneous payments at any merchant (*2) through a smartphone.

From payments at restaurants or other physical stores that sell clothes or other items to medical fees payable at hospitals, tuition fees at tutoring schools, purchases at company cafeterias, and school stores to online purchases, the new service will be available for use in any situation for any good or service, regardless of whether the vendor is on- or offline.

| ・To use the services, simply download a user app and register a personal bank account. For payments at a physical store or facility, check in with the party to be paid and enter your personal identification number. The payment amount will be withdrawn from your bank account instantly and your payment will be complete. ・The service may be used at any merchant (*2). There’s no need to sign prior agreements with individual merchants as in credit transfers. ・Since payments are withdrawn directly from bank accounts, anyone who has an account at the Bank of Yokohama and a smartphone can use the service regardless of whether they own a credit card or debit card. ・No need for advance charges as with electronic money. ・The user app is loaded with features for receiving store coupons and serving as a loyalty stamp card. Useful information from your favorite shops can be managed right on your app. |

| ・Payments are processed through the app for shops (which is compatible with tablets and smartphones), so there is no need to be equipped with devices such as credit card readers or terminals. ・As the Bank of Yokohama remits the total amount in sales to your bank account on the day after the completion of sales, merchants can expect a positive cash flow effect. ・Payment histories, store visits, and other information on customers are accumulated in a database in an administration app for stores, which may leveraged to promote repeat purchases or in marketing measures aimed at boosting the average purchase values. ・Payments are processed by simply operating a tablet or a smartphone. There is no need to deal with cash, which helps to boost efficiency at the cash register during busy hours, and it’s also useful in avoiding cost issues for deliveries or repair. |

(*2) Applicable only to merchants who have a service agreement with the Bank of Yokohama and its smartphone payment

service.

As this service will employ a system that will be directly linked with and withdraw from individual bank accounts, it is scheduled to be equipped with authentication features such as a one-time password provided at the time of registration, a six-digit password for logging in and making payments, and fingerprint authentication. As a contingency against a possible leak in ID or password information, solid security measures will also be in place so payments may not be made in the event that access is made from a device that is normally used, in addition to the requirement of steps for resuming services by the holder of the account

【Future Developments for the “Smartphone Payment Service Linked with Bank Accounts”】

GMO-PG will also offer the “smartphone payment service linked with bank accounts” that it is currently developing to other regional banks and financial institutions. In addition, GMO-PG aims to link services across different regions to enable customers to make payments through the “smartphone payment service linked with bank accounts” at stores, regardless of the bank with which they have an account.

【About the Smartphone Payment Service that GMO-PG is Offering】

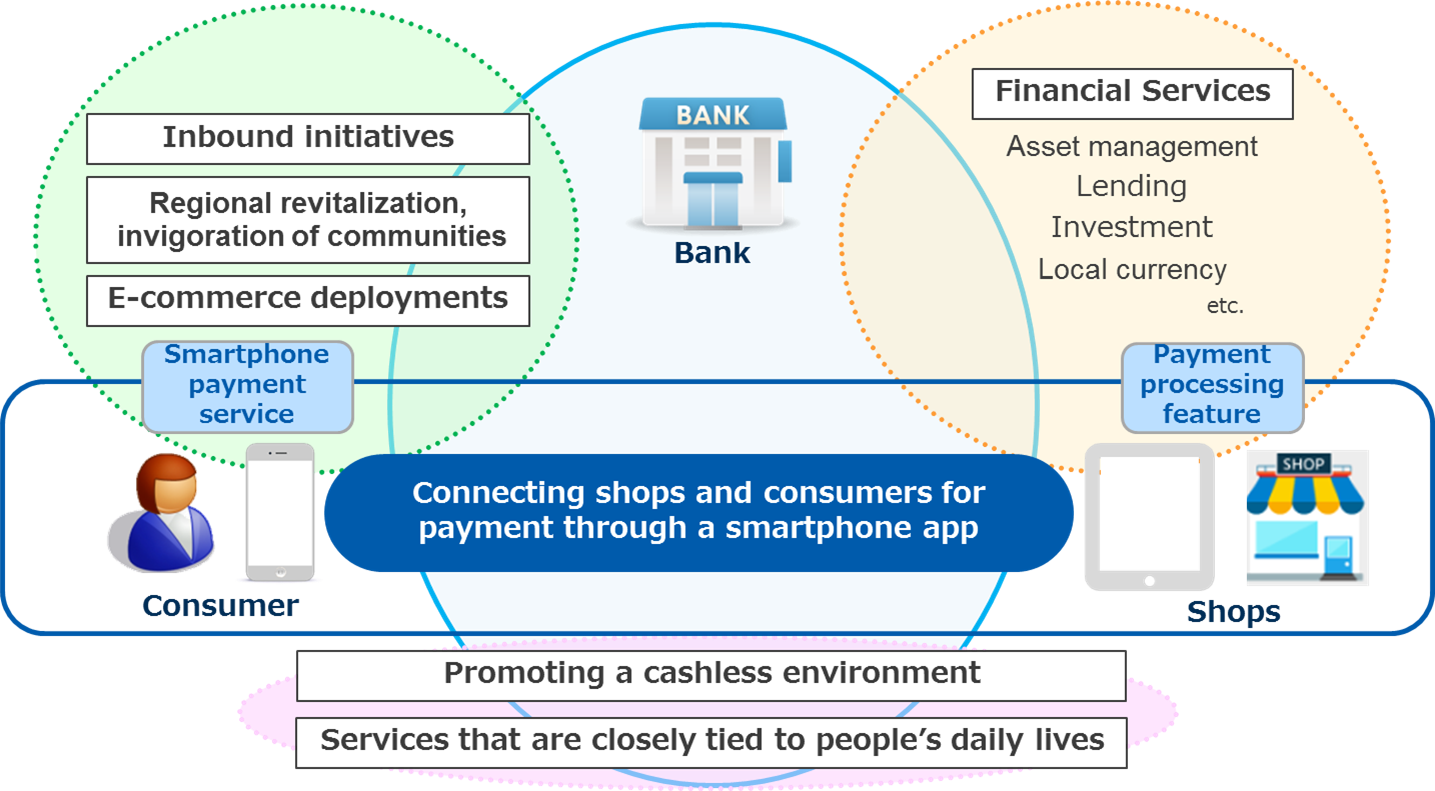

GMO-PG develops and offers smartphone payment services that meet the needs of various financial institutions, including the development of individual smartphone payment services and infrastructure for such services. The following are the three types of infrastructure it develops and offers for payment services which are available through the use of smartphones.

| Payment by Credit Card or Debit Card | Perfect when you are issuing credit cards or debit cards that will be the main avenue for payment services to be offered via a smartphone. |

| Direct Payment from a Bank Account | Ideal when offering smartphone payment services where payments are drawn directly from a bank account. (Currently applying for patent jointly with the Bank of Yokohama; 2016-109869) |

| Two-Way Payment | A method where payments may be made by either credit card or debit card or through direct withdrawal from a bank account via a smartphone. |

Based on its smartphone payment service, GMO-PG also offers combinations between links with financial services such as asset management, loans, investment, and local currencies; measures to bring in inbound demand, for example overseas payments; and systems for electronic commerce or regional revitalization. Financial institutions and other businesses can leverage these measures to offer new services that match their individual initiatives, e.g. Fintech services, the promotion of a cashless environment, regional revitalization, or the offer of services that are closely tied to the daily lives of their users.

<Image of smartphone payment services offered by GMO-PG>

<Image of smartphone payment services offered by GMO-PG>

【GMO Payment Gateway】

GMO-PG offers comprehensive payment services and financial services to 72,569 merchants (as of June 2016, GMO-PG Group) including operators of online shops and sellers of digital content; operators who collect recurring monthly payments, such as NHK and those who offer subscription purchases; and public organizations such as Japan Pension Service and the Tokyo Metropolitan Government.

Services for added value such as online advertising services that contribute to boosted merchant sales, focused chiefly on payment services. Supplying loans and other financial services that support the growth of merchants from a funding perspective and actively engaging in overseas initiatives like overseas payment services, the yearly payment amount processed by GMO-PG exceeds 1.8 trillion yen.

GMO-PG aims to enable both consumers and businesses to enjoy payment methods that are convenient and equipped with high levels of security and to serve as the infrastructure for payment processes in Japan. GMO-PG will promote initiatives for new innovation such as FinTech and contribute to improving the rates of e-commerce in Japan as a leading company in the payment industry.

【Related Links】

・GMO-PG URL : http://corp.gmo-pg.com/en

-

Press Inquiries

GMO Payment Gateway Inc.

Corporate Value Creation Strategy Division

TEL: +81-3-3464-0182

Email: [email protected]

GMO Internet Group

Group Public / Investor Relations

TEL: +81-3-5456-2695

Email: [email protected]

-

Service Inquiries

GMO Payment Gateway Inc.

SmartPay Business Promotion Office

TEL: +81-3-3464-2323 Email: [email protected]